A comprehensive Claims Adjuster Study Guide is essential for aspiring professionals, offering insights into insurance policies, claims investigation, and state-specific laws to ensure thorough exam preparation and career success․

1․1 Overview of the Claims Adjuster Role

A claims adjuster plays a pivotal role in the insurance industry, assessing damages, investigating claims, and determining fair settlement amounts․ They handle various types of claims, including property damage, auto collisions, and personal injuries․ Adjusters conduct interviews, review reports, and inspect damages to ensure accurate evaluations․ Their work requires a strong understanding of insurance policies, legal frameworks, and effective communication skills․ This role is critical in maintaining trust between policyholders and insurance companies, ensuring claims are resolved efficiently and ethically․ The study guide provides detailed insights into these responsibilities, helping aspiring adjusters master the skills needed for success․

1․2 Importance of a Study Guide for Aspiring Adjusters

A study guide is indispensable for aspiring claims adjusters, as it provides structured knowledge on licensing exams, insurance policies, and practical skills․ It equips candidates with insights into state-specific laws, claims investigation techniques, and ethical practices․ The guide acts as a roadmap for mastering key concepts, ensuring confidence and competence during the licensing process․ By offering detailed explanations and practice exams, it helps aspirants navigate complex topics effectively, preparing them for real-world challenges in the insurance industry․

Licensing Requirements for Claims Adjusters

Obtaining a claims adjuster license requires completing pre-study hours, attending training sessions, and passing state-specific exams․ Requirements vary by state, ensuring adjusters are well-prepared to handle claims effectively․

2․1 Texas All Lines Adjuster License

The Texas All Lines Adjuster License is a prestigious credential for claims adjusters, enabling them to handle diverse insurance claims, including property damage, auto collisions, and personal injuries․ To obtain this license, candidates must complete a 30-hour live classroom training or a 40-hour online course․ Attendance is mandatory for live sessions, with a 90% attendance requirement․ Additionally, 10 hours of pre-study are necessary before attending the live class․ This comprehensive training ensures adjusters are equipped to assess damages, conduct interviews, and determine fair settlement amounts efficiently․

2․2 Pre-Study and Training Hours

Aspiring claims adjusters in Texas must complete 10 hours of pre-study before attending a live classroom session․ This ensures a foundational understanding of key concepts․ The live training spans 30 hours, requiring 90% attendance, while online courses offer a self-paced 40-hour program․ These structured hours cover essential topics like insurance policies, claims investigation, and legal requirements․ Completing these hours is crucial for mastering the skills needed to pass the licensing exam and excel in the field․ Proper preparation during these sessions significantly enhances one’s readiness for both the exam and real-world challenges․

2․3 Live Classroom vs․ Online Training

Live classroom training offers interactive learning with instructors, ideal for hands-on engagement․ It requires 90% attendance over 30 hours․ In contrast, online training provides flexibility with a self-paced 40-hour course․ Both methods cover the same material but cater to different learning preferences․ Live training suits those who thrive in structured environments, while online options are perfect for self-disciplined learners․ Both pathways ensure comprehensive preparation for the Texas All Lines Adjuster License exam, with the choice depending on individual needs and learning styles․

Exam Preparation and Format

Prepare for the exam with a focus on multiple-choice questions and state-specific formats․ Utilize practice exams and study strategies to ensure readiness for the California Department of Insurance’s 100-question exam․

3․1 Multiple-Choice Questions and Exam Structure

The claims adjuster exam primarily consists of multiple-choice questions, designed to test knowledge of insurance principles, claims handling, and legal requirements․ The exam structure varies by state, but most include 100-150 questions with a time limit of 2-3 hours․ Candidates must demonstrate understanding of key concepts, such as policy interpretation and damage assessment․ Practice exams are highly recommended to familiarize oneself with the format and improve time management․ Focus on mastering core topics to ensure confidence and accuracy during the test․

3․2 California Department of Insurance Exam Details

The California Department of Insurance (CDI) administers the Insurance Adjuster (Independent) license exam, featuring 100 multiple-choice questions․ Topics include insurance laws, ethics, and claims handling․ Candidates have 2․5 hours to complete the exam, requiring a 70% passing score․ Study guides and practice exams are crucial for success․ The CDI outlines exam content in their Candidate Information Bulletin, emphasizing areas like policy interpretation and legal standards․ Proper preparation ensures readiness for California’s specific regulatory and procedural requirements in claims adjustment․

3․3 Florida Claims Adjuster Exam Specifics

The Florida Claims Adjuster exam consists of 150 multiple-choice questions, covering insurance principles, laws, and claims handling․ Candidates have 2․5 hours to complete the exam, requiring a 70% score․ The Florida Department of Financial Services outlines exam content, focusing on topics like property, casualty, and workers’ compensation․ Study guides and practice exams are essential for success, ensuring familiarity with state-specific regulations and procedures․ Proper preparation helps candidates navigate Florida’s unique requirements effectively․

Recommended Study Materials

Kaplan Financial Education offers in-depth courses, while state-specific study manuals provide localized insights․ Practice exams and online courses are also essential for mastering key concepts and exam readiness․

4․1 Kaplan Financial Education Resources

Kaplan Financial Education offers comprehensive study materials tailored for claims adjuster exams․ Their resources include detailed study guides, practice exams, and online courses designed to cover both general insurance principles and state-specific requirements․ Kaplan’s materials are widely recognized for their clarity and thoroughness, making them an excellent choice for aspiring adjusters․ By utilizing Kaplan’s resources, students can gain a deep understanding of key concepts such as insurance policies, claims investigation, and legal frameworks, ensuring they are well-prepared for the exam and their future career in claims adjustment․

4․2 State-Specific Study Manuals

State-specific study manuals are tailored to address the unique laws, regulations, and insurance practices of individual states․ These manuals provide detailed insights into local insurance codes, claims handling procedures, and licensing requirements․ For example, Texas, Florida, and California each have distinct guidelines that adjusters must adhere to․ By focusing on state-specific content, these manuals ensure aspiring adjusters are well-prepared for regional exam questions and practical scenarios․ They often include practice exams and case studies relevant to the state, making them indispensable for mastering local insurance laws and ensuring compliance with regulatory standards․ These resources are vital for success in state-specific licensing exams and real-world applications․

4․3 Practice Exams and Online Courses

Practice exams and online courses are vital tools for preparing for the claims adjuster exam․ These resources simulate real exam conditions, helping candidates assess their readiness and identify areas for improvement․ Many online courses offer interactive lessons, video tutorials, and downloadable materials, providing flexible learning opportunities․ Additionally, practice exams allow aspirants to familiarize themselves with question formats and time management strategies․ Combining these tools ensures comprehensive preparation, boosts confidence, and increases the likelihood of passing the exam successfully․ They are essential for mastering key concepts and staying ahead in the adjustment profession․

Key Concepts and Skills

Mastering insurance policies, claims investigation, legal frameworks, and communication skills is crucial for success as a claims adjuster, ensuring effective handling of cases and maintaining professional integrity․

5․1 Understanding Insurance Policies

Understanding insurance policies is fundamental for claims adjusters, as it ensures accurate interpretations of coverage, exclusions, and conditions․ This knowledge enables adjusters to investigate claims effectively, determine liability, and make fair settlements․ Policies vary by type, such as auto, home, or liability, and each has specific terms and limitations․ Adjusters must also stay updated on endorsements, riders, and state-specific regulations․ Clear comprehension of policy language ensures compliance with legal standards and builds trust with clients․ It is a cornerstone skill for resolving disputes and delivering equitable outcomes in the claims process․

5․2 Claims Investigation Techniques

Effective claims investigation techniques are critical for determining the validity and extent of insurance claims․ Adjusters must gather and analyze evidence, conduct interviews, and assess damages to ensure fair settlements․ Key techniques include reviewing police reports, medical records, and property assessments․ Adjusters also inspect damaged items, consult experts, and document findings thoroughly․ These methods help identify fraudulent claims and ensure compliance with policy terms․ Proficiency in investigation skills is vital for maintaining accuracy, efficiency, and customer trust in the claims process․ It requires a combination of attention to detail, strong communication, and analytical thinking․

5․3 Legal and Ethical Considerations

Claims adjusters must adhere to strict legal and ethical standards to ensure fair and transparent claims handling․ This includes understanding state insurance laws, policy terms, and regulatory requirements․ Ethical practices involve maintaining honesty, avoiding conflicts of interest, and treating claimants with respect․ Adjusters must also protect sensitive information and avoid any actions that could be perceived as fraudulent or unethical․ Compliance with these principles is crucial for upholding professional integrity and maintaining public trust in the insurance industry; Proper training and ongoing education are essential to navigate these complex legal and ethical responsibilities effectively․

5․4 Communication and Negotiation Skills

Effective communication and negotiation skills are vital for claims adjusters to resolve disputes efficiently․ Adjusters must clearly articulate findings, listen actively, and empathize with claimants․ Strong negotiation skills help reach fair settlements while maintaining company interests․ Proper communication ensures all parties understand the process, fostering trust and cooperation․ Adjusters must also document discussions accurately to avoid misunderstandings․ Developing these skills through training and practice is essential for successful claims resolution and maintaining positive relationships with clients and stakeholders․ Clear and concise communication is key to a smooth claims process and professional success in this field․

The Claims Process

The claims process involves reporting, investigating, and resolving insurance claims․ It includes assessing damages, determining settlement amounts, and ensuring fair outcomes for all parties involved efficiently and accurately․

6․1 Initial Claim Reporting

Initial claim reporting is the first step in the claims process, where policyholders notify their insurer about a loss or incident․ This phase involves documenting details, securing evidence, and conducting a preliminary investigation․ Adjusters gather accurate information to assess the claim’s validity and scope․ Timely and thorough reporting is crucial for preventing fraud and ensuring fair, efficient settlements․ This step sets the foundation for the entire claims process, making it essential for adjusters to handle it with precision and care to achieve satisfactory outcomes for all parties involved․

6․2 Damage Assessment and Inspection

Damage assessment and inspection involve evaluating the extent of damage to determine a fair settlement․ Adjusters conduct on-site inspections, review repair estimates, and consult experts to ensure accurate valuations․ They document all findings, including photos and detailed notes, to support their conclusions․ This step is critical for identifying covered losses and preventing over or underpayments․ Efficient and thorough inspections ensure that claimants receive appropriate compensation while maintaining policy terms and insurer guidelines․ Proper documentation also protects against disputes, making this phase vital for a smooth claims process․

6․3 Determining Settlement Amounts

Determining settlement amounts involves evaluating the extent of damage, policy coverage, and applicable limits․ Adjusters review repair estimates, depreciation, and prior claims to calculate fair payouts․ They consider factors like deductibles, coverage limits, and exclusions to ensure compliance with policy terms․ Negotiation with claimants or legal representatives may occur to reach agreement․ The goal is to balance fairness to the claimant with adherence to company guidelines, ensuring settlements are reasonable and defensible․ Accurate documentation supports the final decision, fostering trust and efficiency in the claims resolution process․

6․4 Final Settlement and Claim Closure

Final settlement involves reaching a mutually agreed-upon payment amount, ensuring all parties are satisfied․ The adjuster verifies documentation, issues payment, and confirms closure․ Communication is key to ensure clarity and compliance with policy terms․ Legal requirements are reviewed to prevent disputes․ Once settled, the claim is officially closed, and records are updated․ Proper closure ensures efficiency and maintains trust between the insurer and claimant, marking the end of the claims process․

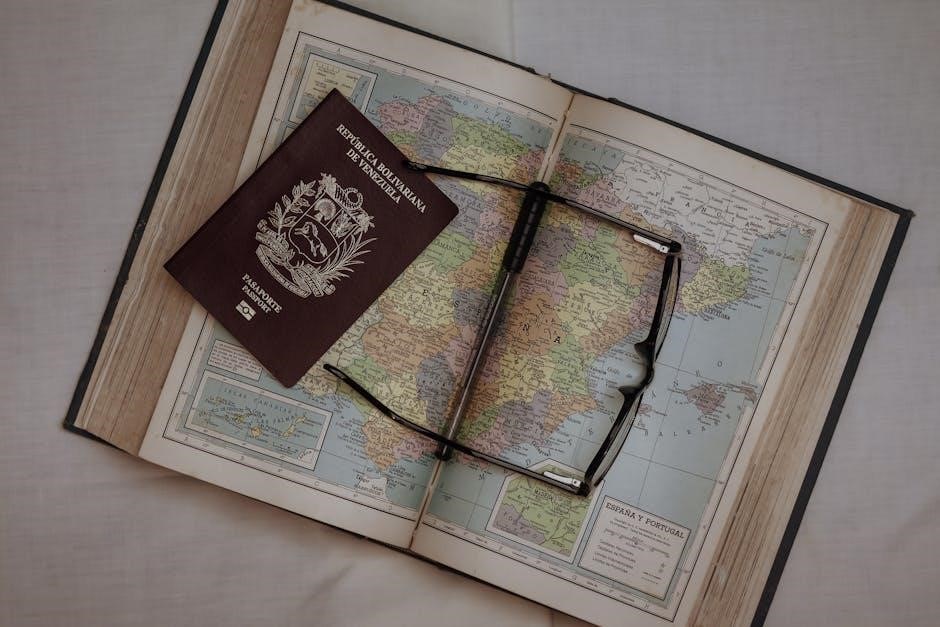

State-Specific Requirements

Each state has unique licensing and regulatory requirements for claims adjusters, such as Texas pre-study hours and California-specific exams, ensuring compliance with local insurance laws․

7․1 Texas Adjuster Licensing

Obtaining the Texas All Lines Adjuster License requires completing 10 hours of pre-study and either 30 hours of live classroom training or 40 hours of online coursework․ Attendance is mandatory for live sessions, with a 90% requirement․ The curriculum covers property, casualty, and other insurance-related topics․ Upon completion, candidates must pass a state-approved exam and submit their application to the Texas Department of Insurance․ This license is highly sought after due to its broad scope and reciprocal agreements with other states, making it a valuable credential for claims adjusters․

7․2 Florida Adjuster Exam Questions

The Florida Claims Adjuster exam features multiple-choice questions designed to test knowledge of insurance principles, legal standards, and claims handling practices․ The exam covers topics such as policy interpretation, loss assessment, and ethical considerations․ Study guides and practice exams are recommended to familiarize candidates with the format and content․ Passing the exam is a critical step toward obtaining the Florida Adjuster License, which is essential for professionals aiming to work in the state’s insurance industry․ Proper preparation ensures a high likelihood of success on this challenging assessment․

7․3 California Department of Insurance

The California Department of Insurance (CDI) regulates insurance practices and issues licenses to claims adjusters․ Aspiring adjusters must meet specific requirements, including passing the CDI’s licensing exam․ Study guides are essential for understanding California’s insurance laws, policy interpretations, and claims handling protocols․ The CDI provides detailed resources and exam outlines to help candidates prepare․ A thorough review of the study guide ensures familiarity with state-specific regulations and exam formats, increasing the likelihood of success․ This section focuses on the CDI’s role in licensing and its impact on adjuster professionalism in California․

Professional Development

Professional development is crucial for claims adjusters, involving ongoing education, certifications, and networking to stay updated in the field․ This guide supports building a strong foundation for long-term success․

8․1 Certifications for Advancement

Obtaining certifications like the Certified Property and Casualty Underwriter (CPCU) or Associate in Claims (AIC) enhances career prospects․ These designations demonstrate expertise in claims handling and insurance principles, boosting credibility․ The study guide provides detailed preparation materials for such exams, ensuring a strong foundation in practical skills and knowledge․ Earning these certifications can lead to advanced roles, higher salaries, and increased industry recognition, making them a valuable investment for professional growth and long-term success in the claims adjustment field․

8․2 Continuing Education Requirements

Continuing education is crucial for licensed claims adjusters to maintain certification and stay updated on industry standards; Many states require adjusters to complete a set number of hours in approved courses, focusing on ethics, legal updates, and claims handling․ The study guide provides resources and courses that align with these requirements, ensuring professionals can meet their obligations efficiently․ Regular updates in the guide reflect changes in insurance laws and practices, helping adjusters adapt and excel in their roles while adhering to regulatory standards․

8․3 Networking Opportunities

Networking is vital for claims adjusters to build relationships and stay informed about industry trends․ The study guide highlights professional associations, conferences, and online forums where adjusters can connect with peers․ Attending events like the National Association of Insurance Adjusters (NAIA) conference or joining online groups provides access to resources, mentorship, and job opportunities․ These connections not only enhance career growth but also offer insights into best practices and emerging technologies in the field, ensuring adjusters remain competitive and well-informed in their professional journey․

Tools and Technology

Claims adjusters utilize advanced tools like claims management software, digital inspection devices, and data analytics to streamline processes, enhance accuracy, and improve decision-making in their daily operations․

9․1 Claims Management Software

Claims management software is a vital tool for adjusters, enabling efficient organization and tracking of claims․ These platforms often feature automated task assignments, real-time status updates, and integrated reporting tools․ They streamline communication between adjusters, policyholders, and stakeholders, ensuring seamless collaboration․ Advanced systems include data analytics to identify trends and improve decision-making․ Many solutions offer mobile accessibility, allowing adjusters to manage claims remotely․ By leveraging these technologies, adjusters can enhance productivity, reduce errors, and deliver faster resolutions, ultimately improving customer satisfaction and operational efficiency in the insurance industry․

9․2 Digital Inspection Tools

Digital inspection tools revolutionize how claims adjusters assess damage․ Using drones, 3D scanners, and high-resolution cameras, adjusters can capture detailed images and videos of damaged properties․ These tools enable remote inspections, reducing the need for on-site visits and speeding up the claims process․ Advanced software analyzes the data, providing precise measurements and damage assessments․ Digital solutions also improve accuracy, reduce disputes, and allow for better documentation․ By integrating these technologies, adjusters can handle claims more efficiently, ensuring faster and fairer resolutions for policyholders while maintaining high professional standards in the insurance industry․

9․4 Data Analysis in Claims Adjustment

Data analysis is a cornerstone of modern claims adjustment, enabling adjusters to make informed decisions; By leveraging advanced analytics, adjusters can identify trends, detect fraudulent claims, and optimize settlement amounts․ Tools like predictive modeling and machine learning help assess risks and forecast potential losses․ Detailed reports generated from claim data ensure transparency and accountability․ Effective data analysis not only enhances operational efficiency but also improves customer satisfaction by facilitating fair and timely resolutions․ As technology evolves, data-driven approaches will continue to play a pivotal role in shaping the future of claims adjustment practices․

Ethical Considerations

Ethical practices are vital in claims adjustment, ensuring fairness, transparency, and integrity․ Adjusters must avoid conflicts of interest, maintain confidentiality, and adhere to legal and regulatory standards․

10․1 Maintaining Professional Integrity

Maintaining professional integrity is crucial for claims adjusters, as it ensures fairness and transparency in handling insurance claims․ Adjusters must avoid conflicts of interest, remain impartial, and uphold ethical standards․ This includes accurately assessing damages, communicating clearly with policyholders, and adhering to legal and regulatory requirements․ Professional integrity also involves safeguarding sensitive information and avoiding any actions that could compromise the trust placed in them․ By adhering to these principles, adjusters foster a reputation for reliability and uphold the integrity of the insurance industry․ Ethical decision-making is essential for long-term success and credibility in this field․

10․2 Avoiding Conflicts of Interest

Avoiding conflicts of interest is vital for claims adjusters to maintain trust and ethical standards․ This involves refraining from personal or financial relationships that could influence decisions․ Adjusters must remain impartial when assessing claims, ensuring fairness to all parties․ They should disclose any potential conflicts and avoid situations where personal gain could interfere with professional duties․ Adhering to these principles prevents legal and reputational risks, fostering a transparent and trustworthy claims process․ Upholding ethical practices is essential for maintaining credibility in the insurance industry․

10․3 Best Practices in Claims Handling

Best practices in claims handling emphasize clear communication, transparency, and empathy throughout the process․ Adjusters should thoroughly investigate claims, ensuring accuracy and fairness in settlements․ Timely responses and updates to policyholders are crucial to maintain trust․ Adhering to legal and ethical standards is non-negotiable, as is treating all parties with respect․ Continuous learning and staying updated on industry changes are also key to providing effective service․ By following these practices, adjusters can build trust, resolve claims efficiently, and uphold their professional reputation while ensuring satisfaction for all involved parties․

A well-structured Claims Adjuster Study Guide equips professionals with essential knowledge, from insurance principles to state-specific laws, ensuring exam success and a successful career in claims adjustment․

11․1 Final Tips for Exam Success

To excel in the claims adjuster exam, thoroughly review insurance policies, practice with sample questions, and focus on state-specific laws․ Utilize flashcards for key terms and concepts․ Time management is crucial—allocate 1-2 minutes per question․ Stay calm and read each question carefully to ensure understanding․ Leveraging the Claims Adjuster Study Guide effectively will enhance your preparation and confidence․ Prioritize areas where you need improvement and seek clarification on complex topics․ Consistent practice and dedication are key to achieving success in becoming a licensed claims adjuster․

11․2 Utilizing the Study Guide Effectively

Maximize your preparation by actively engaging with the Claims Adjuster Study Guide․ Break down complex topics into manageable sections and review them systematically․ Highlight key concepts and create notes for quick revision․ Practice with included sample questions to assess your understanding․ Focus on weak areas and seek additional resources if needed․ Regularly review and apply the strategies outlined in the guide to build confidence․ By following a structured study plan and utilizing the guide’s resources, you’ll be well-prepared to tackle the exam and achieve your licensing goals efficiently․